Mortgage customer experience journey

Applying qualitative research methods to surface insights and improve the mortgage customer experience.

Our client wanted to achieve an increase in mortgage applications and needed to redesign the digital experience strategy for researching, applying and managing mortgages.

CXCO was engaged to use observational and ethnographic research to understand the mortgage customer experience for first time-buyers, savvy-buyers, and investors. We communicated the experience through in depth customer journeys, identifying strategic innovation opportunities, and provided recommendations to improve the service and digital experience.

The opportunity

Our banking client had a strategy to become the primary bank for their customers while increasing their mortgage book, extending their market reach and successfully competing with larger banks. Consumers recognised the bank for their direct savings products, but many did not know or considered this financial institution when they were considering a mortgage.

The bank viewed the digital channel as the primary channel through which they could increase the number of mortgage applications, with a vision for it to become a key channel for enabling customers when researching, selecting and applying for a mortgage.

The bank needed to gain a clear understanding of the mortgage customer experience, customer needs and expectations, and customers’ preferred channels of use, information requirements, and network that supported and influenced their mortgage buying decisions. They needed to know how they compared to other banks from a customer experience and interaction perspective, and from this understanding define a unique value proposition they could offer mortgage customers.

The bank had a lack of insight into what customers valued, needed and expected from them when researching, selecting and applying for a mortgage and in turn, gaps in their experience strategy for the mortgage product and service.

Our approach

Discover

Discover

A multi-disciplinary team from our client and CXCO worked together to define the problem, clarify the intent and identify customer types to include in the research. A kick-off workshop identified research topics and mapped known pain points, and call listening provided insight into the questions customers asked when researching and applying for a mortgage.

Contextual research

Contextual research

The internal knowledge gained in the Discover was expanded upon through qualitative research with customers. A recruitment matrix was created to ensure we had breadth and depth across customer types, and contextual inquiries were conducted with first time-buyers, savvy-buyers, and investors to understand their needs, experience, motivations, scenarios of use, and tasks when researching, selecting and applying for a Mortgage.

Sense making

Sense making

Affinity diagramming of audio and observational data was used to uncover themes and surface insights. This included identifying points of failure with the current mortgage experience and opportunities for the future digital experience strategy.

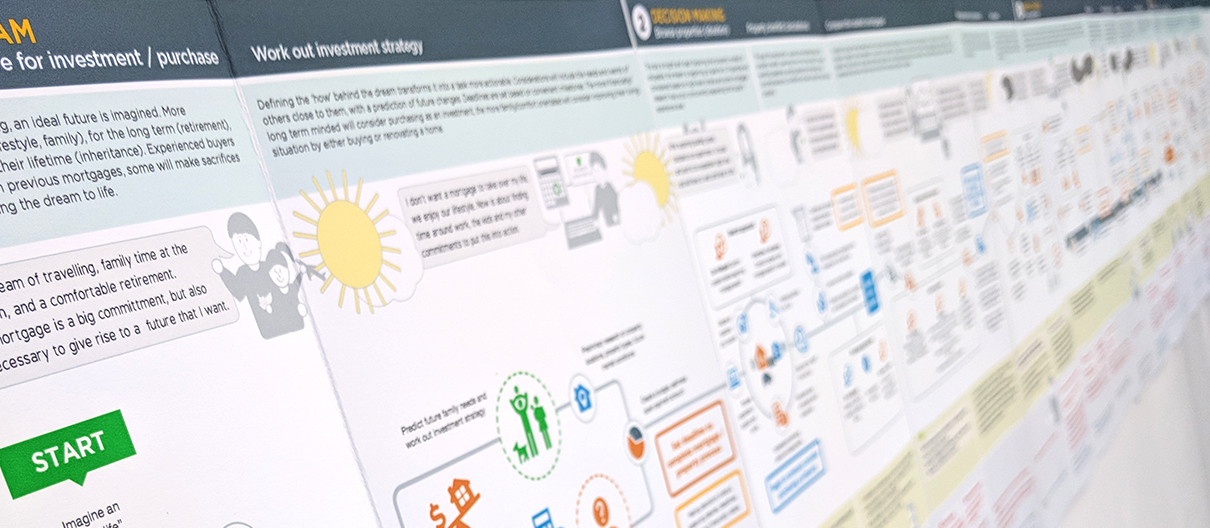

Customer journey maps

Customer journey maps

We communicated the insights, customer needs, pain points and opportunities through a customer journey and report. These were presented to key stakeholders including executive sponsors, business heads, and service teams.

CXCO produced a customer journey as a key deliverable for the client.

Key outcomes

- Insights provided clear direction on investment options and enabled our client to identify and develop the capabilities required to improve the customer experience

- The business gained an understanding of points of failure with the existing mortgage product and service that informed the creation of a roadmap of initiatives focused on increasing value

- Evidence-based customer journeys were used to build empathy, to up-skill employees, and when on-boarding new employees